Original article ISPreview UK:

CityFibre’s plan to roll-out their 10Gbps capable full fibre broadband (FTTP) network into some poorly served parts of the Winchester area of Hampshire (England), which is part of their Project Gigabit contract for the same region, appears to have been significantly slowed by some unexpected ecological and planning obstacles.

Just to recap. CityFibre originally secured the £104m (public subsidy) supported Project Gigabit contract for Hampshire (Lot 27) back in July 2023 (here), which was also backed by a private investment of £54m from the operator itself and aimed to reach more than 75,500 premises (55,570 currently contracted) in hard-to-reach areas (i.e. locations with no plans for future gigabit coverage). The goal was to complete this build by March 2029.

NOTE: CityFibre is owned by Antin Infrastructure Partners, Goldman Sachs, Mubadala Investment Company, Interogo Holding etc. The FTTP network, which covers 4.7 million UK premises (4.5m RFS), is supported by UK ISPs such as

Vodafone,

TalkTalk,

Zen Internet,

Sky Broadband and more (local ISP availability does vary).

The first homes finally began to be connected under this contract back in April 2025 (here), but this has so far only covered 5,780 of the contracted premises (10%) and the plan to extend that up into the Winchester area appears to have hit a few furry snags. You see, in order to deploy their network, CityFibre first needs to be able to support it by established a new Fibre Exchange (FEX), which is essentially a micro-edge data centre.

CityFibre’s FEXs can vary in size, but they’re often roughly the size of a shipping container, served by two geographically diverse fibre routes, and including some space for backup power (A+B UPS and standby generators) in case of an outage or failure of the mains supply. Such sites are usually capable of serving tens of thousands of premises.

What’s the FEX problem in Winchester?

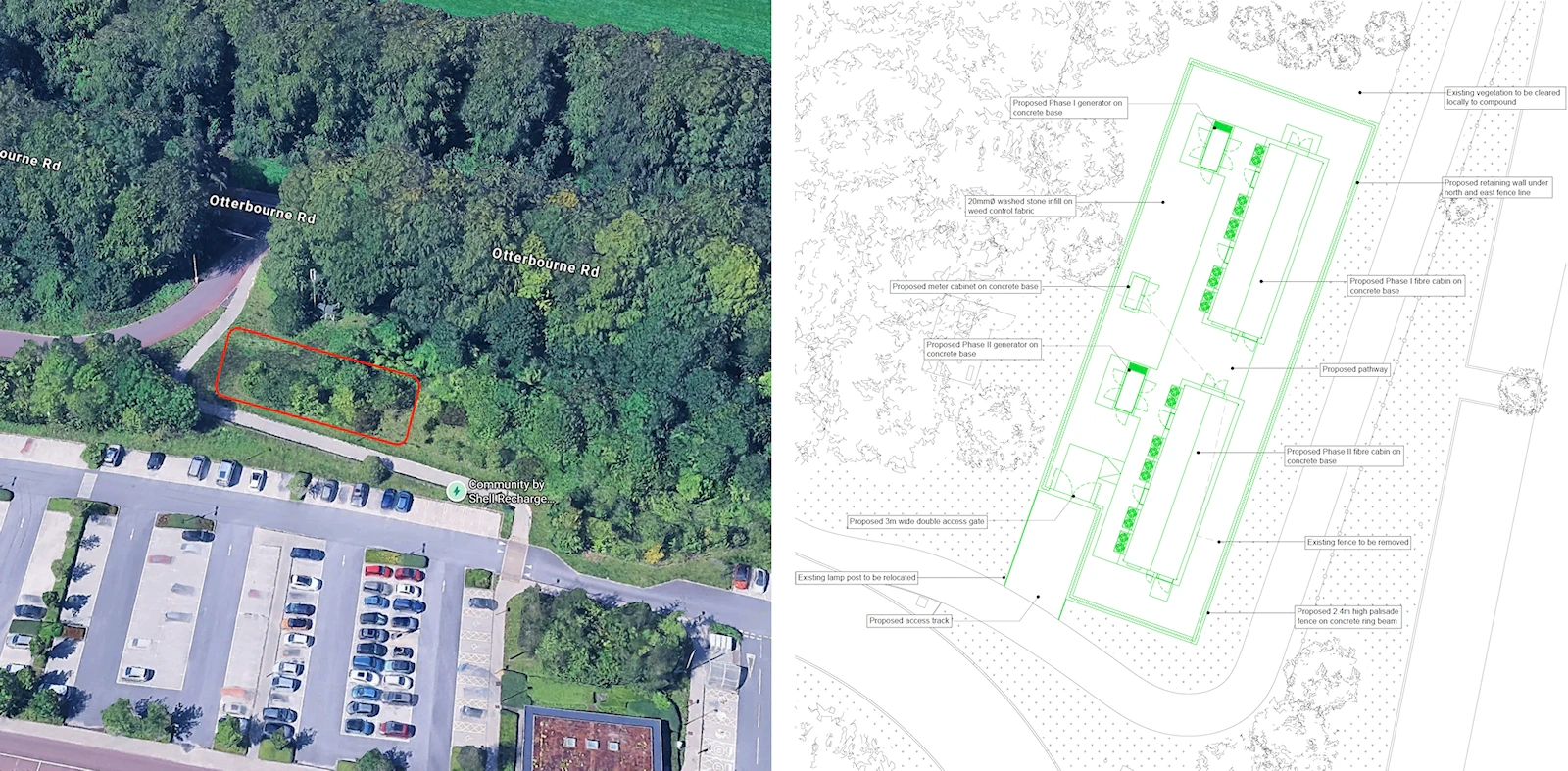

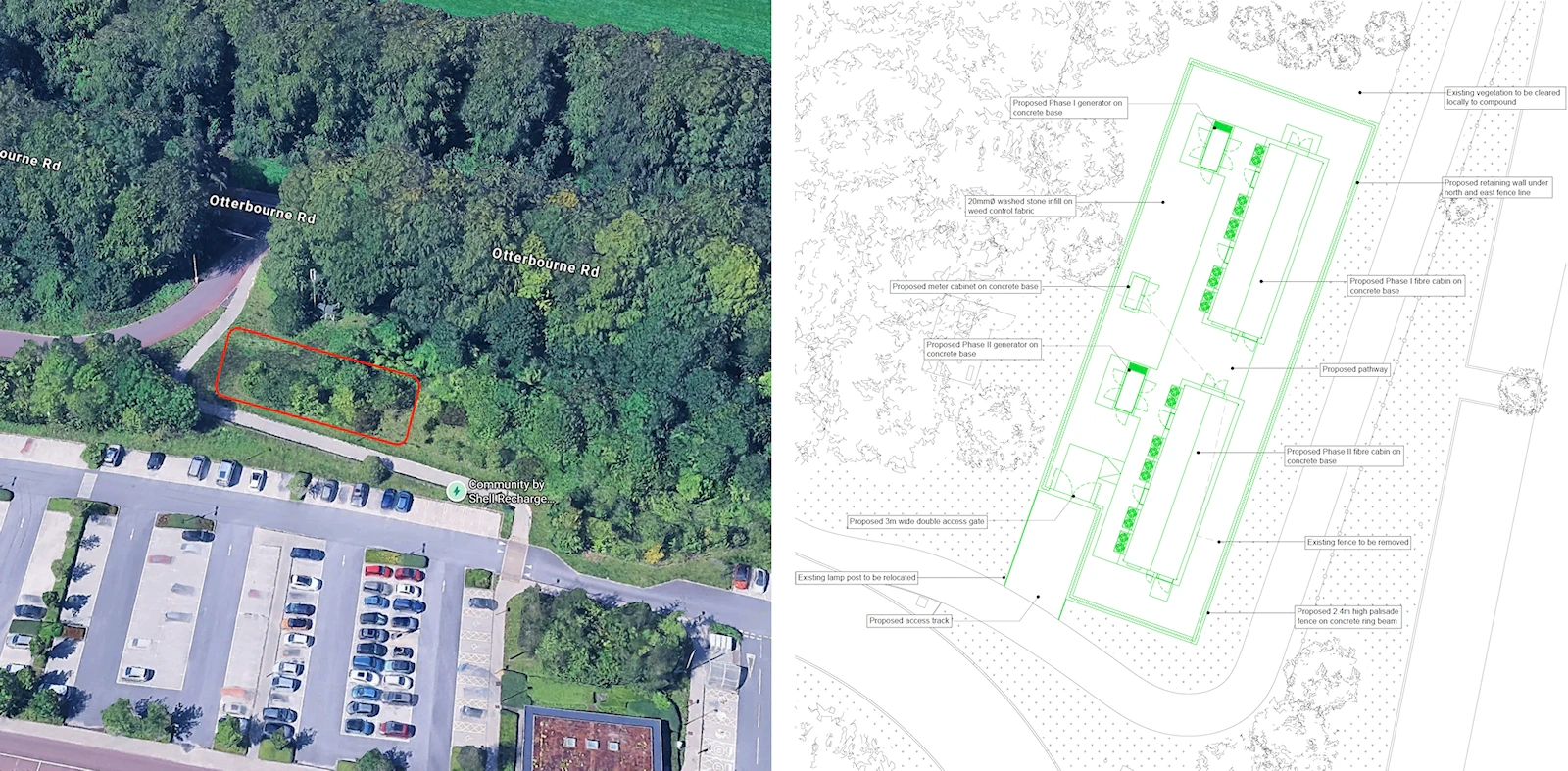

The problem is that the site where they’re intending to deploy this FEX, which one local resident of the area (John) described to ISPreview as being akin to a “small, scrubby plot next to a car park” (Park and Ride), has become stuck in the council’s planning process for the best part of a year due to dormouse-related ecological surveys and what appears to be some generally slow progress by officers at Winchester City Council.

As one of the agents for the planning application said: “It is a park and ride car park, so urban infrastructure, not some unspoilt rural landscape setting. The site is a fairly ordinary area of grassland and the main features of the landscape, such as the mature trees to the west, are not being affected while the development would not be visible from anywhere other than within parts of the park and ride facility.”

We’ve mocked up a bit of an example image of the area, with the proposed site plan alongside below.

Great care often goes into the rolling out of new broadband networks. As a result, such projects often run into problems when their most ideal locations for new infrastructure suddenly and unexpectedly clash with the presence of protected wildlife. Both network operators and planning offices then have a duty to take care to stay within the law.

In this case a lengthy dormouse-survey was conducted as part of the process and the planning documents revealed the presence of such animals. Hazel dormice, their breeding sites and resting places are rightly protected by law (Conservation of Habitats and Species Regulations) and that’s a good thing. But it does clearly create a problem for CityFibre, which have thus far been pressing to keep their current planning application alive.

Nick Cutler, WCC Ecologist / Biodiversity Officer, said (Jan 2026):

“I have finally got round to reviewing the Dormice Survey Report and have a few comments.

I am happy with the proposed methodology which follows the Hazel Dormouse Mitigation Handbook (Mammal Society, 2025) which recorded evidence of dormice onsite and in the surrounding habitat through the use of

footprint tunnels.

The report states under Survey Assessment Conclusions that “it should be assumed that dormice could be present, in low density, in all connected woodland on-site”. However, evidence of dormice have been found in tunnels onsite so it is clear dormice are present onsite and a protected licence will be required to carry out the works.

Natural England requires an assessment of the population size and the impact the works will have on that population, for licence applications.”

In short, CityFibre will need a special licence if they wish to continue with the work (this applies if they can’t avoid disturbing the dormice or damaging their habitats) and so far they haven’t changed their mind, which isn’t surprising after so much time, money and effort has already been expended just to get this far.

The council is now calling on CityFibre to explain why there is such a need for the development (i.e. the importance of Project Gigabit to rural broadband connectivity), as well as how they’d protect the local Dormice population (e.g. sometimes they can be moved or protected within the site) and why there is no satisfactory alternative to that site.

Suffice to say that this process is likely to drag on for a bit longer, which just goes to show how challenging it can sometimes be to get new networks deployed into rural areas that need them. But equally there are no quick fixes when it comes to dealing with protected species and there’s similarly no guarantee that a similar problem might not crop up even if a different site were found, which would in any case require a total restart of the whole laboriously slow planning process.

“For rural residents still waiting for modern broadband connectivity, and not covered by commercial rollouts, it’s becoming a point of real frustration, and it raises questions about how local planning processes can inadvertently stall national infrastructure upgrades,” said Winchester resident John. CityFibre declined to comment on the matter and the council didn’t respond when we asked them to comment.