Original article Total Telecom:Read More

News

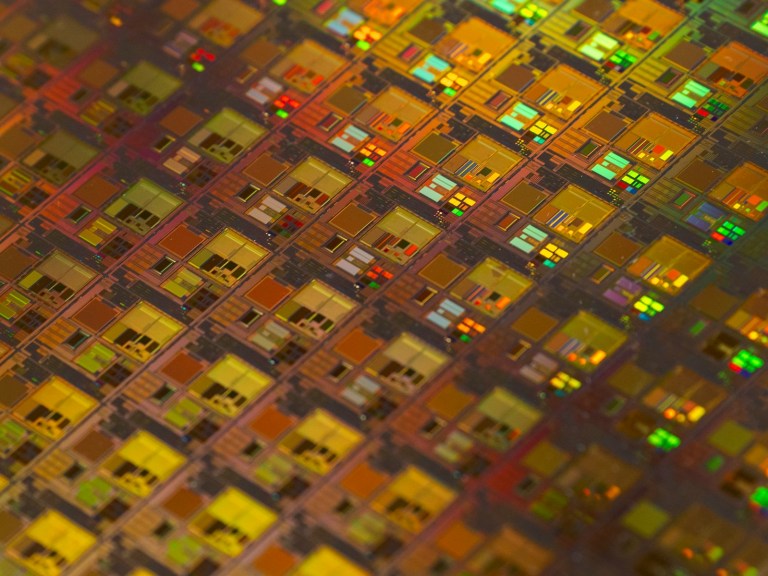

Despite efforts to expand capacity, semiconductor players are struggling to keep pace with demand

As the AI boom continues to gain momentum, two of the world’s leading chipmakers, SK Hynix and Samsung Electronics, are warning that their expansion plans will not move fast enough to ease supply chain bottlenecks.

The companies, both which reported their latest financial results this week, said that the memory chip supply crisis would be unlikely to alleviate for the next two years despite their best efforts.

“We are planning a substantial increase in our capital expenditure in 2026 as AI-driven demand is likely to continue,” said Kim Jae-june, executive vice-president of Samsung’s memory business, as reported by the Financial Times. “But supply shortages are likely to worsen as capacity expansion is expected to be limited this year and next.”

SK Hynix has plans to invest 19 trillion won ($12.9bn) in the construction of a semiconductor packaging facility in Cheongju, while Samsung is investing 60 trillion won ($41.5 billion) in its P5 factory in Pyeongtaek, South Korea, which broke ground in November last year.

Both investments are driven by the surge in demand for High Bandwidth Memory (HBM), a crucial part of AI accelerators and data centre GPUs, as well as other memory chip technology; SK Hynix says it expects the HBM market to continue to grow significantly between 2025 and 2030, with projections indicating a compound annual growth rate of 33% until 2030.

However, the additional capacity being generated from these new facilities will take time to realise.

“Demand is growing sharply, but it takes time to expand capacity, so the mismatch in demand and supply is worsening, pushing chip prices higher,” added Song Hyun-jong, president of SK Hynix, in the same FT report.

The extent of the memory bottleneck is already being felt acutely across the world. The cost of dynamic random access memory (DRAM), for example, has skyrocketed since 2024, and is set to double again this year.

At the same time, the industry is also in the midst of a significant shift, moving from the current HBM3E technology to the more advanced HBM4. These next generation memory chips will offer higher data transfer speeds (exceeding 1 TBps per stack) and more than double the bandwidth of HBM3E, making them ideal for AI data centres.

SK Hynix is currently the global leader in this latest memory design, accounting for roughly 60% of the overall market, according to Macquarie Equity Research. Samsung, however, is expected to soon challenge this position, beginning production of its own HBM4 chips next month.

Needless to say, this memory bottleneck is making both SK Hynix and Samsung very rich.

SK Hynix reported a net profit of 97.15 trillion won ($67.9 billion), up 46.8% year-on-year, while Samsung saw profits rise to 45.21 trillion won ($31.6 billion, up 31.2% year-on-year.

Keep up to date with all the latest telecoms news with the Total Telecom newsletter

Also in the news

World Communication Award Winners 2025

Ofcom clears the way for satellite-to-smartphone services

LG Uplus’s AI voice call app glitch leaks user data

The post South Korean memory-makers warn of AI supply chain crunch appeared first on Total Telecom.