Original article ISPreview UK:Read More

A new survey from Viasat and the GSMA (Global System for Mobile Communications Association), which questioned 12,390 mobile phone users across twelve markets (including the UK), claims to have revealed the “booming consumer demand” for Direct-to-Device (D2D) satellite services (mobile calls, texts and internet data).

Several satellite-based broadband operators are currently developing services that can directly connect to unmodified consumer Smartphones via regular mobile spectrum bands. Some examples of this include Starlink (Direct to Cell), AST SpaceMobile and Viasat (i.e. they have a vested interest in the survey). In fact, some phones, like the latest iPhone series from Apple and Samsung, already have a basic communication system that can work via satellite (e.g. for emergencies).

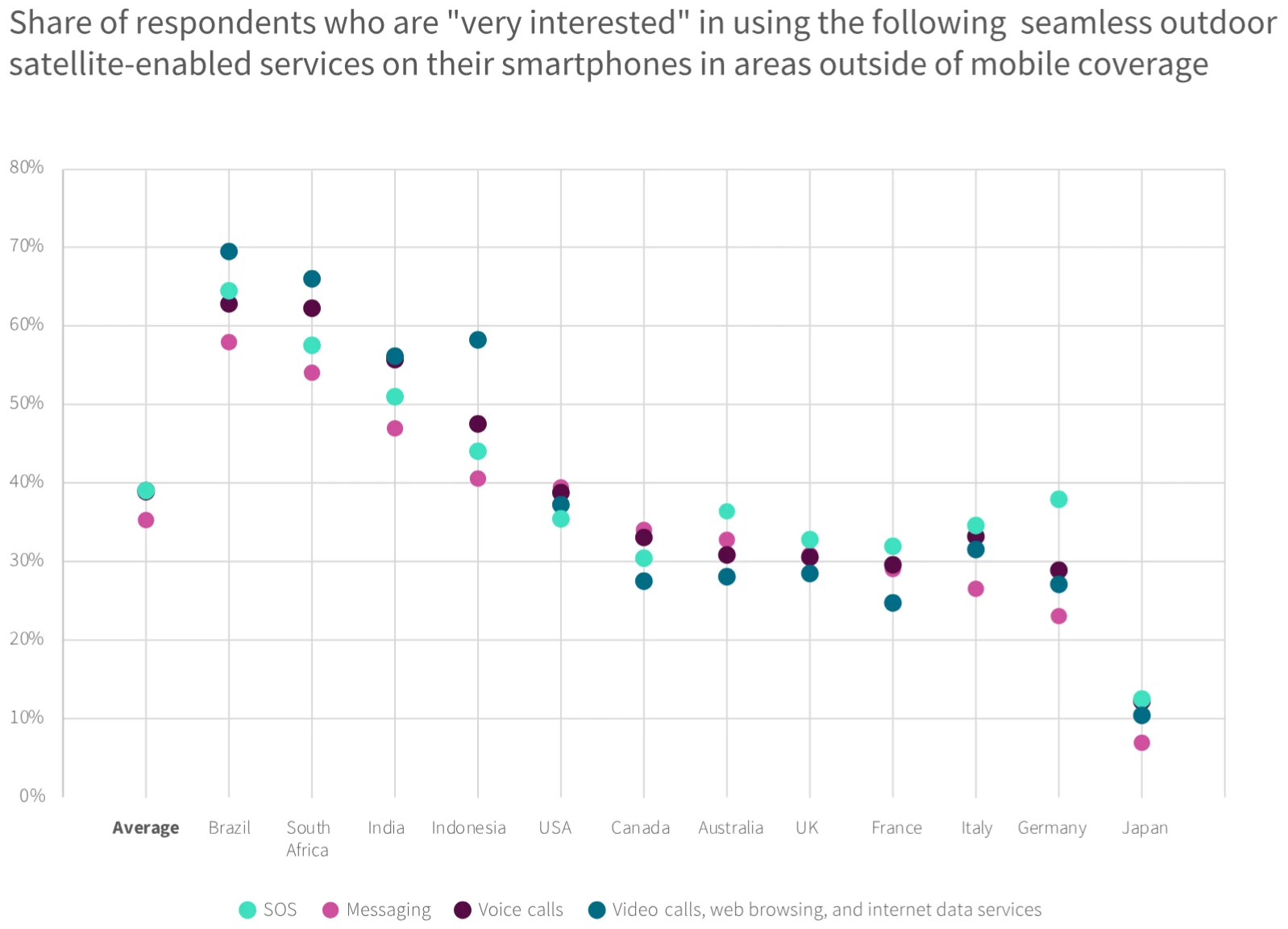

Suffice to say that Viasat and GSMA Intelligence were keen to know how much interest there might be in such services. In order to do this, they surveyed 12,390 mobile phone users about their existing terrestrial coverage, their awareness and interest in satellite-based services, and their willingness to pay for these services and to switch mobile network providers to access these services.

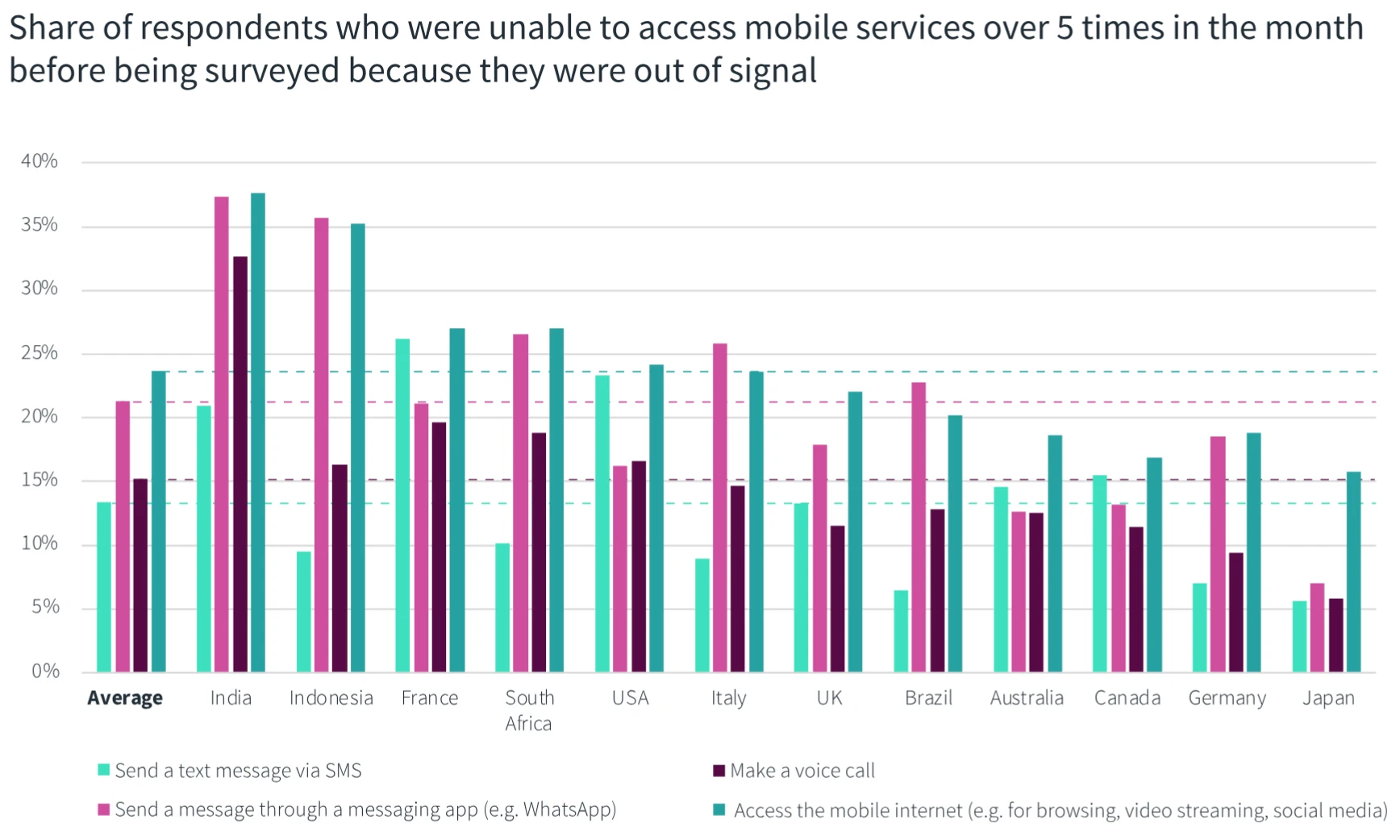

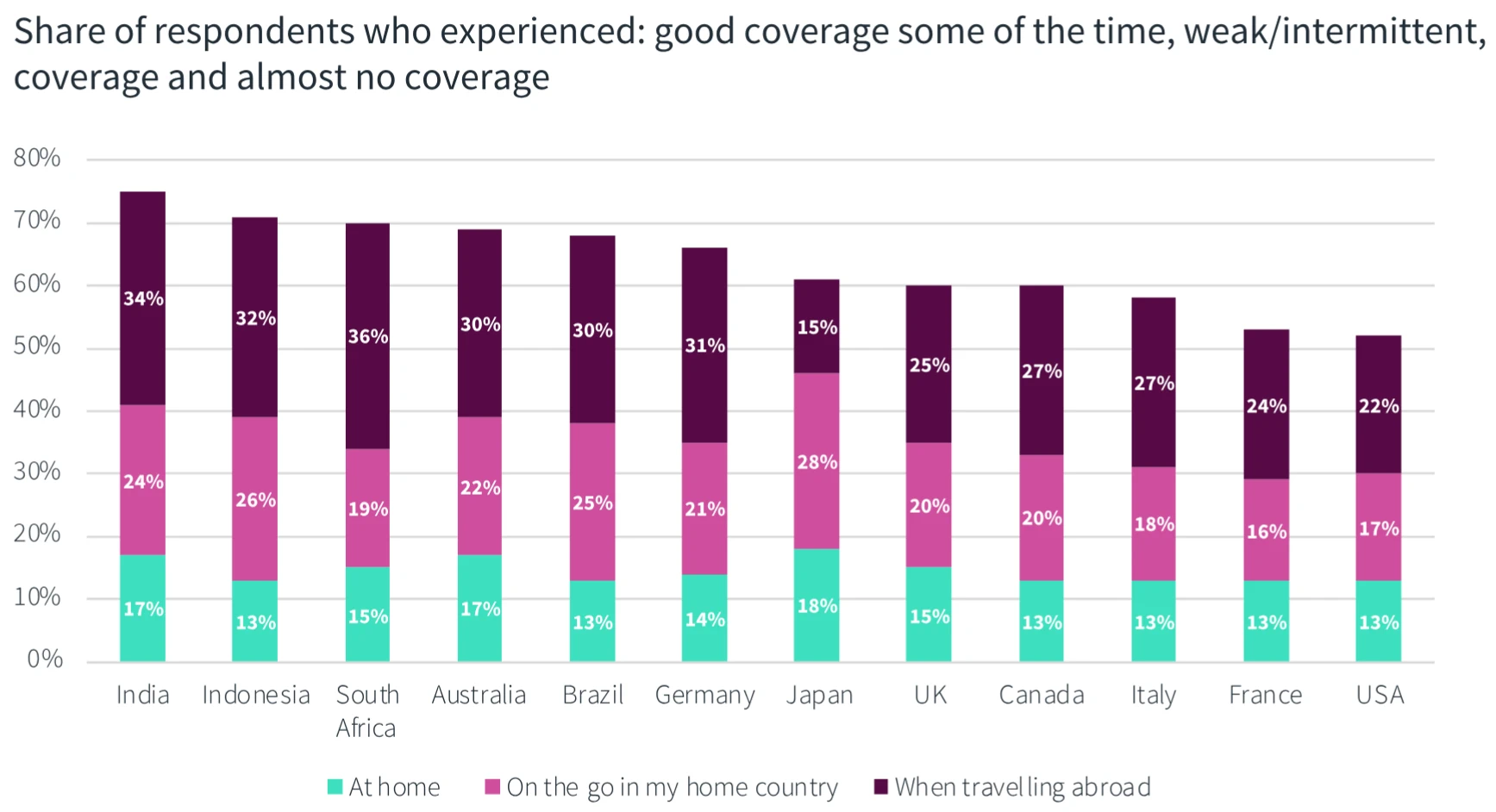

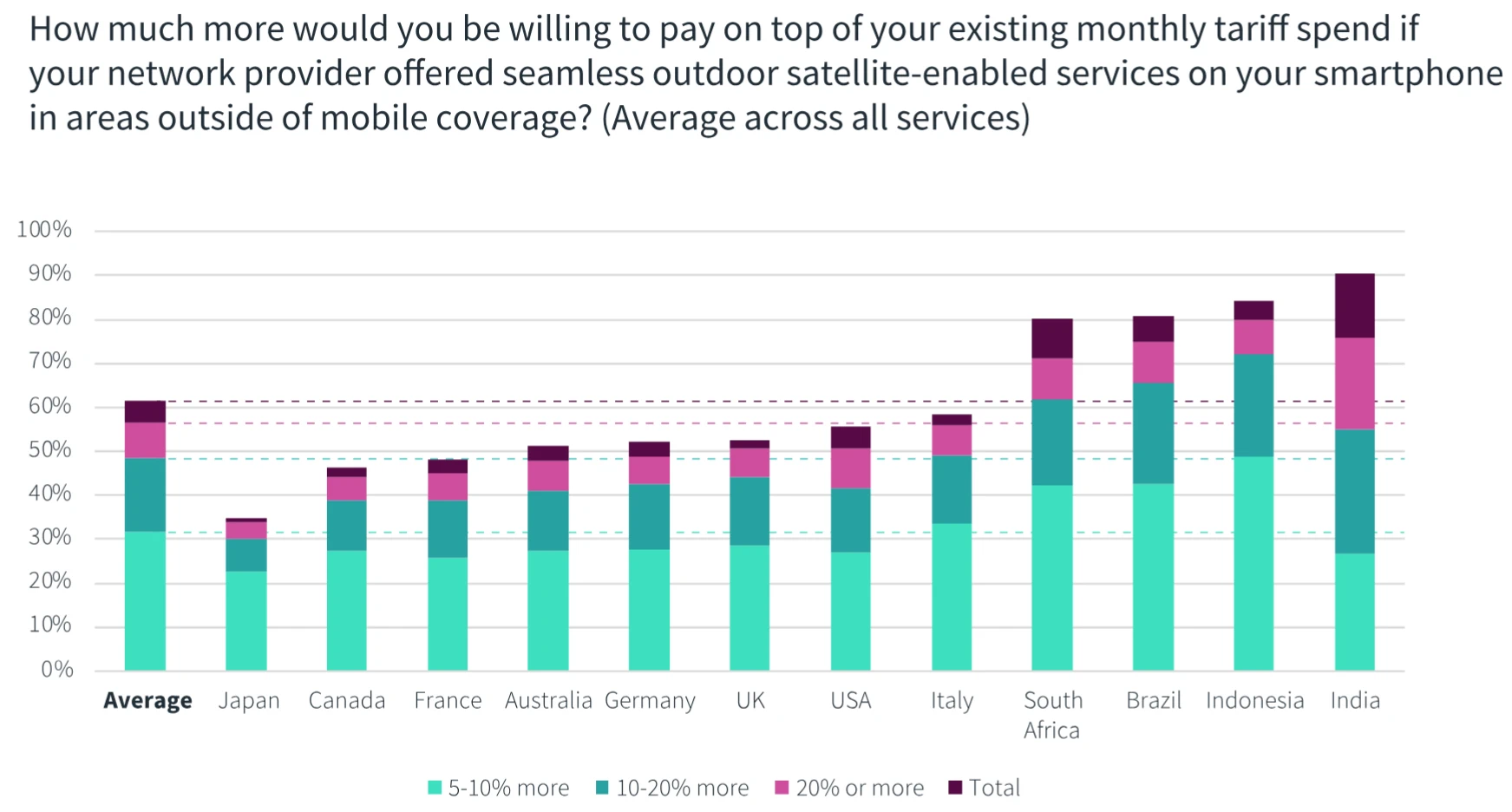

The survey found that, on average, more than a third of consumers report losing access to basic mobile cellular services at least twice a month. Perhaps as a result, 60% of consumers are willing to pay extra for satellite services, while 47% of global phone users stated they would switch to a different operator if they didn’t get cell coverage in traditional dead spots.

Consumers are apparently also ready to pay an additional 5-7% on their monthly phone bill for D2D satellite features, and even more in developing regions like India (9%). But awareness varies – with 74% of consumers aware of satellite features in India compared with only 25% in Japan, creating a ‘marketing gap’ which telcos must navigate to capitalise on demand.

Tim Hatt, Head of Research & Consulting, GSMA Intelligence, said:

“Six in ten say they’re willing to pay extra for D2D services, and nearly half would switch provider to get them, a decisive signal of demand and a clear revenue runway for operators. With satellite services aligned to 3GPP standards and moving from trials to commercial reality, the race is on to deliver D2D at scale, first messaging and voice, then data – so operators can differentiate on reach, resilience and customer trust.”